The shift from ethical issues to financial issues: climate change isn’t just a moral issue anymore; it’s also a financial one.

BHP Billiton is currently facing three class-action lawsuits relating to damages from Brazil’s worst environmental disaster, the collapse of a dam at the Samarco mine in 2015. The disaster killed 19 people, flooded 3 villages and destroyed the surrounding environment, including clean water used by over 13 million people. Shareholders claim BHP neglected to disclose the risk of the dam’s failure to the stock market, misleading investors. BHP will be fighting this class action, which is the record damages claim in British legal history at $US5 billion.

The impact of litigation on holding fossil fuel companies accountable for the kinds of damages they foresaw decades ago could be substantial. Prosecutors are interested in understanding if companies are lying to the public about the risks of climate change, or to investors about how such risks might financially impact fossil fuel organisations.

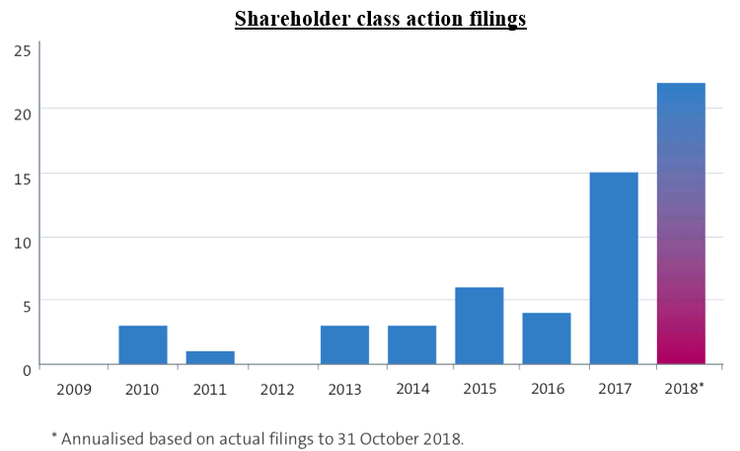

Class action filings have increased dramatically over the last couple of years and are continuing to rise. Specifically, shareholder class action filings, have increased by 600% per cent in under 5 years and are continuing to rise.

With the increase in shareholder class action filings, comes an increase in public attention centering environmental, social and governance (ESG) risks and the impact they have on financial stability. Where ESG and its prospective risks used to fall into ethical investments, it is now argued that it falls under a financial issue.

Source: Allen’s Class Action Risk 2018

https://www.allens.com.au/pubs/pdf/class/classactionRISK.pdf

The argument is that climate change isn’t a moral issue anymore but a financial one. These litigations are based upon the shareholder’s belief that companies need to start addressing climate-related risks in their annual reporting. By doing this, a company would be governing these risks with a higher degree of audit and scrutiny. It would demonstrate commitment to ESG-related risks and managing them effectively, not just unsubstantiated policy creation.

In 2017, the Commonwealth Bank of Australia (CBA) was litigated by shareholders for not having climate change as a material risk in their annual financial report. Shareholders believed that CBA should have known about their investments and potential risks and shared this with their shareholders.

The Task Force on Climate-related Financial Disclosures (TCFD) responded to this issue by recommending that banks and other organisations include climate-related risks in their audited annual financial statements. CBA has subsequently disclosed climate risk in its annual report and the case has been dropped.

Recently, Gloucester Resources decided not to pursue an appeal following the rejection of their mining exploration license in regional NSW. The appeal was based partly on the contribution to global warming. David Morris, head of Environmental Defenders Office of NSW said “This is the leading case for how decision-makers should take into consideration a project’s impact on climate change, and on the social health and wellbeing and cultural health of a community.”

TCFD, which was established by the Financial Stability Board (led by Founder and Chairman, Michael Bloomberg), advocates to help develop voluntary, consistent climate-related financial risk disclosures, providing information to investors, lenders, insurers, and other stakeholders with corporates.

The TCFD’s recommended disclosures are divided into four thematic areas: governance, strategy, risk management, and metrics and targets.

Source: Final Task Force on Climate-related Financial Disclosures Recommendations Report.

The TCFD disclosure recommendations are intended to be:

· Adoptable by all organisations.

· Included in mainstream annual financial filings.

· Designed to solicit decision-useful, forward-looking information on financial impacts.

· Focused on risks and opportunities related to transition to a lower-carbon economy.

The TCFD recommended disclosures, while voluntary, are being considered by several national governments for varying levels of endorsement and regulation.

Paul Fisher on his retirement as deputy head of the Bank of England’s Prudential Regulation Authority summed up the issue simply, “Anybody who is a long-term asset-holder is potentially exposed to climate risk.”

Globally renowned investment companies like Vanguard are setting policies to support shareholder demands for greater transparency. This is happening ahead of mandatory reporting requirements being implemented by regulatory figures, highlighting how actions to address climate change are evolving to be driven by investor and client interest.

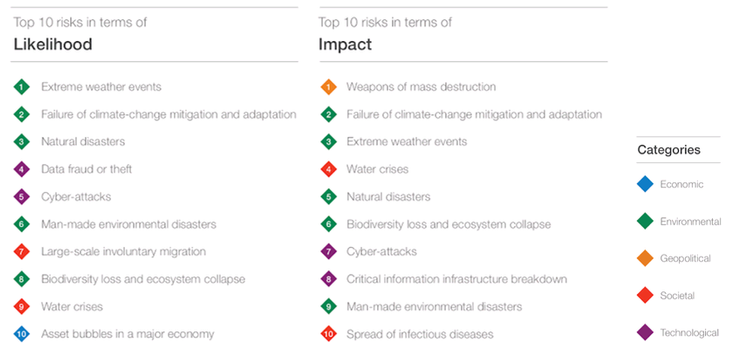

Extreme weather events from climate change aren’t the only risk to affect the financial stability of businesses globally. There are many ESG-related risks that affect businesses financially, for example, water crisis, energy price shock, and data fraud or theft. The World Economic Forum’s 2019 Global Risks Report displays the top 10 most likely risks and their impacts for the upcoming year.

Source: World Economic Forum, Global Risks Report 2019

http://www.mmc.com/insights/publications/2019/jan/global-risks-report-2019.html

Class actions will continue to happen across a range of environmentally-related risks as they transition into material risks on annual reports for companies across the world. As we shift into a zero-carbon economy, environmental and financial risks will become more and more intertwined to one another. Reporting tools such as TCFD will aid risk management processes, and reduce the risk facing companies from potential shareholder class actions.

The problem here is that investors are demanding climate change risks to be assessed and disclosed in a measurable and consistent way by corporations. Instances of shareholder litigation are happening more and more frequently, with many instances created due to a lack of communication between investor relations and shareholders.

Tony Watson, Partner at ESG Responsible Investments and leader in the implementation of climate adaptation measures for state significant infrastructure delivery across ANZ, stated, “The remedy to the problem is known and centers around understanding material risks, long term management and transparency. Through starting the journey of climate related financial disclosure, we will see the early adopters reaping the benefit of commercial resilience with a positive shareholder and stakeholder social license, the lifeblood a thriving modern business.”

Written by ESG Responsible Investments (www.esgri.com) and noted sources.

Contact us to discuss how your organisation can reduce ESG risks, create an effective ESG strategy, reduce their carbon footprint and better manage ESG risk in your supply chain.