I landed yesterday from a week in NYC meeting a range of fund & asset managers, environmental social & governance (ESG) reporting houses, and investment banks (thank you all for making the time to meet!). What an interesting week, especially coming from the point of view of the Australian market. One key observation has become increasingly apparent and has really been cemented from this trip: our ASX listed businesses do not understand ESG, the risks associated with not addressing it, and the proven materiality driving it.

At ESGI we focus on sustainability and ESG strategy from a bottom line performance improvement approach and work with government, public, and private organisations. Long gone are the days of the balance sheet & annual report giving the total picture of a company; investors and other stakeholders now require increased transparency beyond the balance sheet.

An astounding number of investment managers have signed and committed to the UN Principles of Responsible Investment (PRI). In order to adhere to the principles they committed to, investment managers are using ESG reports available on their Bloomberg and Reuters terminals to invest using a range of reported ESG KPI’s.

What is driving investment managers to commit to the PRI framework?

-

Investors are requesting it.

-

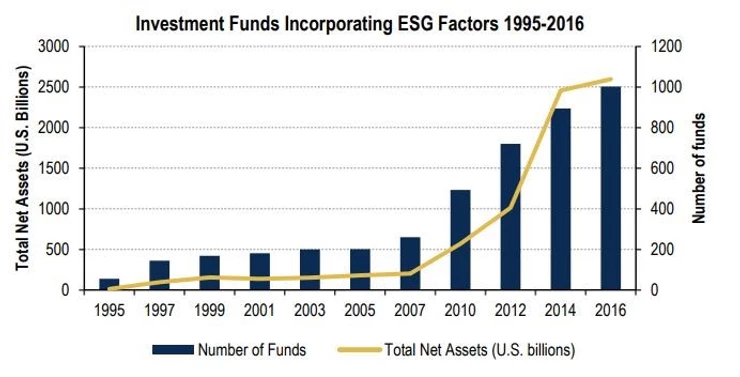

ESG focused ETFs & Funds outpace their competitors.

-

Companies addressing ESG correctly typically outperform their competitors.

-

Material bottom line performance.

The rapid growth in ESG reporting in recent years has been driven by a range of external and internal factors.

-

Increasing investor awareness and concern regarding corporate accountability and transparency.

-

Investors face an information deficit – there is increasing public pressure from Super funds in Australia and abroad regarding company compliance.

-

Investors are looking for non-financial & ESG information to allow comparison to sector peers.

-

Investors are searching for product differentiators that will make their portfolios more competitive but less volatile.

-

Investors now uses ESG as a measurement tool for non-financial risk.

With one out of three ASX 200 companies classified as having poor ESG disclosure in 2015, an evident disconnect exists between investor demand and corporate reporting.

So, why aren’t ASX listed businesses setting up ESG reporting frameworks to engage with this rapidly growing pool of funds?

There is a lack of direction globally, without one accepted ESG reporting framework. The closest we have is the Sustainability Accounting Standards Board, focused on increasing disclosure to investors. One question I often get asked is who is going to take the lead on creating this change: investors, CEO’s, or market reporting requirements. We’re not sure yet, but the Australian investment community is demanding more data.

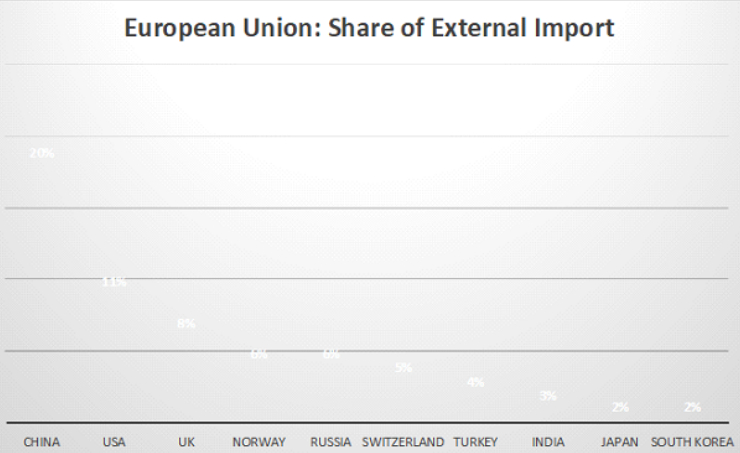

The Australian market one of the largest superfund and pension fund markets in the world, who are highly motivated to invest ethically. These are investors who have a long-term, strategic approach to investing, not interested in short-termism. ESG enables an opportunity to connect with these investors and communicate strategic ESG initiatives to generate real value.

ASX companies need to rise to the challenge to communicate ESG effectively, or be left behind!

By James Cronan – ESGI James.cronan@43.216.228.42

Contact us to discuss how your organisation can reduce ESG risks, create an effective ESG strategy, reduce their carbon footprint and better manage ESG risk in your supply chain.