The Biden Plan for a clean energy revolution and environmental proposal will make a federal investment of $1.7 trillion over the next ten years, leveraging additional private sector and state and local investments to total to more than $5 trillion. These investments will be used to achieve the target of 80% renewable energy use by 2030 and have all electricity usage be renewable by 2035. The plan is expected to save an estimated 317,500 lives in the US over the next 30 years due to the significant drop in air pollution from fossil fuels.

https://www.theguardian.com/us-news/2021/jul/11/biden-administration-clean-energy-climate-crisis

Morningstar tracked Sustainable fund increases with net flows of $51 billion in 2020 were more than double the total for 2019 and nearly 10 times more than in 2018. Australasian retail investors now have access to 135 sustainable Australasia-domiciled funds. Majority of these funds employ exclusion from investment in certain controversial areas such as nuclear, tobacco, weapons and land mines.

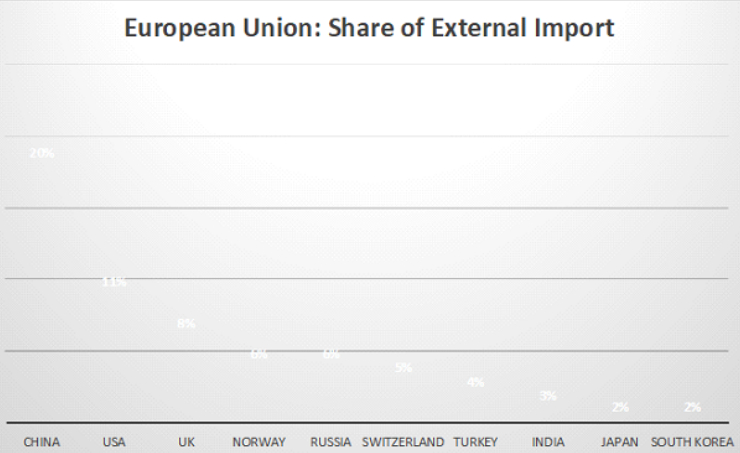

Participation in the UN Principles for Responsible Investment has soared as well, from 700+ signatories with $21 trillion AUM in 2010 to 3000+ signatories with over $100 trillion AUM in 2020. The number of investor signatories increased by 29% to 2701, where 521 are asset owners. UNPRI has also seen explosive growth in the cumulative number of policy interventions, mainly being driven by corporate ESG disclosure.

https://www.unpri.org/about-the-pri/annual-report-2020/6811.article

UK Government rejects proposals to prevent UK companies using Uyghur slave labour in response to plans put forward by the Business Energy and Industrial Strategy Committee. The Committee said UK firms in fashion, retail, media and technology could all be linked to the use of forced labour in Xinjiang and had called for fines and blacklisting of those that failed to change.

Mastercard launches global Sustainability Innovation Lab for climate conscious digital products and solutions, and support impact-driven startups and customers. The new lab aims to explore the potential that new technologies such as AI, 5G and quantum computing can have on dealing with climate change. Mastercard is further incentivising climate action in finance through their Climate Fintech Cards and Payments Challenge as well as their Start Path start-up engagement program.

Singapore Stock Exchange has proposed making the Taskforce on Climate Related Financial Disclosures (TCFD) guidelines mandatory for all entities. They have also suggested that sustainability reporting should include key metrics such as GHG emissions, energy consumption, water consumption, waste consumption and renewables usage. The proposal for increased climate disclosure is being driven by lenders, investors and other key stakeholders.

Taskforce on Nature-related Financial Disclosures (TNFD) has G7 backing and from 2023 will begin impacting investment from nature-negative outcomes from their business. Currently it is very difficult to attain data that can construct a rich picture regarding the net positive or negative environmental impacts that businesses have, therefore, the TNFD will assist in understanding a companies impact on the environment. Because the G7 have taken the initiative to enforce TNFD it is now being discussed by G20 nations.

Class actions and policy enhancements to meet the demands of ESG investment transparency reach record levels.

Figure 1.1 Number of policy revisions identified by the UNPRI with relation to ESG

Chinese investment worries with corporate governance not meeting ESG criteria anymore:

https://www.ft.com/content/ecf7de34-e595-4814-9cbd-4a5119187330

Apple commits $30 million to diversity, equity and inclusion:

https://www.esgtoday.com/apple-commits-30-million-to-racial-equity-and-justice-initiatives/

Contact us to discuss how your organisation can reduce ESG risks, create an effective ESG strategy, reduce their carbon footprint and better manage ESG risk in your supply chain.