Main Takeaways:

-

ESG offers institutional investors such as super funds and global fund managers a product differentiator to take to market.

-

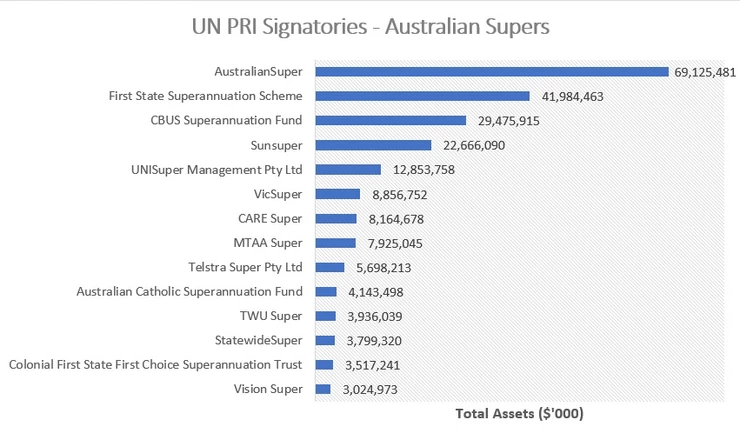

Several of the largest super funds in Australia are UN PRI signatories, agreeing to make investments with ESG in mind.

-

One of the main challenges for companies to compete in the ESG space is that there is no standardised reporting framework or benchmark.

-

Australian investors are interested in ESG because it aligns with their values, and studies show it offers on par or superior returns to non-ESG focused investing.

As a result of the Global Financial Crisis, coupled with changing wealth holder demographics, Australian investors are searching for differentiators that will make their portfolios more competitive but less volatile. The Australian market is stagnating with growth, real GDP, and economic growth forecasts are hotly debated. Investors and fund managers recognise that sticking to the status quo may be the path of least resistance, but not the path that incorporates all aspects of their fiduciary duty. Consequently, ESG has transitioned from a topic relevant only to niche funds to one with trillions of dollars in investments worldwide. Amongst leading investors, ESG is seen as a measure of risk, a safeguard of reputation, and as an indicator of financial and nonfinancial performance.

Australia is an investment market with significant involvement from large super funds and pension funds. Ethical and responsible investment offers a differentiator to these long-term investors, who are looking for a unique narrative to offer their clients that offers on par returns. Super funds, such as AustralianSuper, Colonial First State, and Sunsuper, have signed on to the UN PRI and agree to its six principles, the first of which is to “incorporate ESG issues into investment analysis and decision-making processes”.[1] ESG provides a strong investment mandate for these funds.

In addition to super and pension funds, other institutional investors and global funds managers are using ESG as an investment mechanism. According to Responsible Investment Association Australasia’s 2016 Benchmark Report, in Australia, over $600 billion in assets under management is committed to responsible investing — that’s around half of all assets under management nationally.[2] Globally, there are several institutions with ESG research branches, including Thomson Reuters, Bloomberg, Sustainanalytics partnered with Morningstar, MSCI, and the Dow Jones Sustainability Index. However, there is no standardised framework for listed companies to report on ESG, and the internal decision making process varies amongst investors. This presents a challenge to both investors and businesses, since it is unknown what is important to certain investors, and the data provided by companies may be insufficient for the investor’s needs.

ESG isn’t a one size fits all, risk management tool — for it to be most attractive to investors and most useful for the company, it must be tailored to an individual business’s value proposition, stakeholders, and strategy. A mining company in Perth doesn’t have the same risks as a Queensland bank, however some of the risks they manage are similar, such as human capital management or executive remuneration schedules.

Investors recognise this, and may evaluate ESG through a number of screening techniques tailored for different sectors: for example, an investor may use ESG to calculate a weighted average cost of capital, or in creation of a company scorecard. The investor may also engage businesses directly, or through proxy voting or policy statements.

Therefore, the next steps for Australia’s ESG reporting journey is for decision-makers within businesses to gain familiarity with the language of ESG, which will lead to understanding of the key metrics institutional investors want to see reported on, and how these metrics need to be presented to the market. As a listed entity, the obligation of reporting on risks is to the shareholders, whether it is mums and dads, or billion dollar super funds. The interest in ESG from both of these investor classes is apparent, and for good reason: businesses with high ESG scores have been shown to have competitive or better market value.[3]

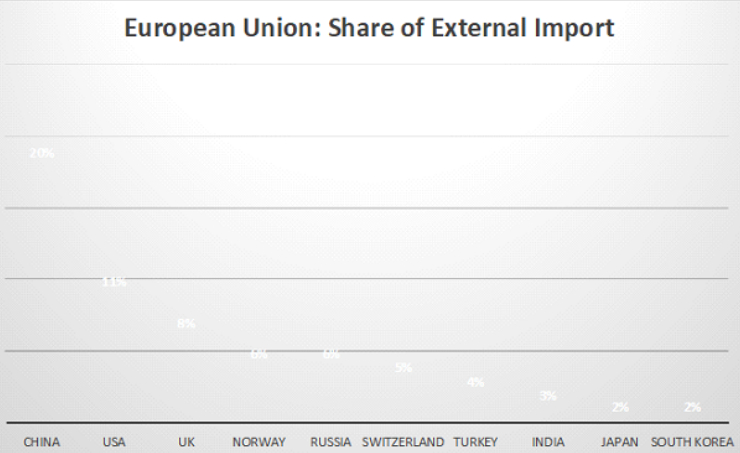

We are still a long way from institutional changes in the Australian market due to ESG — however, the momentum to transition to a low-carbon economy is growing. The way forward is through informed reporting by listed entities and strategies to combat underperformance in the environmental, social, and governance space. An effective strategy will implement zero capital cost solutions to improve ESG performance and produce material benefits. While Australia is new to ESG relative to Europe, this presents investors and companies the perfect opportunity to trail-blaze competition and incorporate ESG in its early years.

By Kate Saulenas

[1] UN PRI. The six principles: signatories’ commitment. Retrieved from https://www.unpri.org/about/the-six-principles.

[2] Responsible Investment Association Australasia. (2016). Responsible Investment Benchmark Report 2016 Australia. http://responsibleinvestment.org/wp-content/uploads/2016/11/RIA413_Benchmark_Report_A4_OZ_v5.pdf.

[3] Bank of America Merrill Lynch. (2016, December 18). Equity Strategy Focus Point: ESG: good companies can make good. stocks.https://www.bofaml.com/content/dam/boamlimages/documents/articles/ID17_0028/equitystrategyfocuspoint_esg.pdf.

Data for UN PRI Signatories – Australian Supers Sourced from:

[1] APRA. (June 2016 ed., issued 2017, February 1). Annual My Super Statistics.http://www.apra.gov.au/Super/Publications/Pages/Annual-MySuper-Statistics.aspx.

[2] UN PRI. (Accessed June 2016). Signatory Directory.https://www.unpri.org/directory/

Contact us to discuss how your organisation can reduce ESG risks, create an effective ESG strategy, reduce their carbon footprint and better manage ESG risk in your supply chain.